Succession Planning: Family Investment Companies

Is it possible to protect, give away and grow your assets all at the same time?

The landscape of personal taxation and compliance is ever changing. Add to that every family has unique dynamics and objectives as regards their estate planning needs and the result is that the structures and vehicles available to meet these needs have also had to evolve.

At this event, our experts will consider how one vehicle, the Family Investment Company, can be used for tax efficient succession planning for people whose estate is likely to incur substantial IHT charges on their death.

The roundtable format will enable delegates to be fully immersed in the discussion with plenty of opportunity to get involved and ask questions on the topics that are important to them.

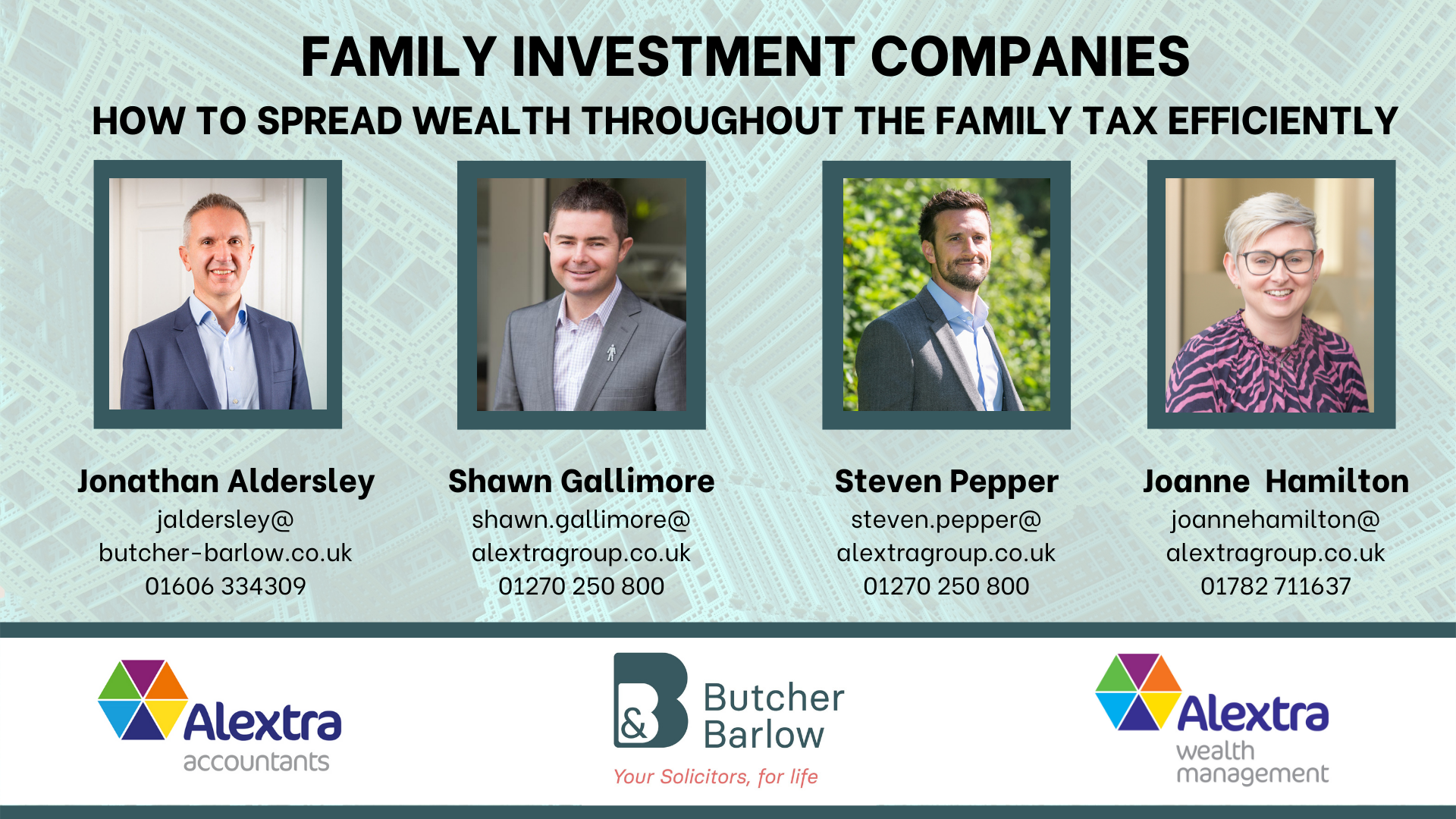

Taking place on Wednesday 20th July at 1.00pm at Sandbach Town Hall, our panel will answer all your questions on Family Investment Companies, including:

Shawn Gallimore from Alextra Accountants – the basics

- What is a Family Investment Company and how can it protect the family wealth?

Jonathan Aldersley from Butcher & Barlow Solicitors – the legal advice

- How do I set up a FIC?

- What voting rights and dividend entitlement should I give to the children?

- How do I exercise control over the FIC?

- What are the ongoing costs and responsibilities with the FIC?

Jo Hamilton from Alextra Accountants – the tax advice

- Why is a simple trust not sufficient for my succession planning?

- Are there any tax liabilities on the creation on the FIC?

- What happens if the shares increase in value – is tax payable on the increase?

- Is the dividend income taxable?

- Could HMRC challenge the FIC?

Steven Pepper from Alextra Wealth Management – The financial advice

- How can I invest money which is in a FIC?

- Can I protect my Estate from any IHT payable on death, due to setting up the FIC?

Since numbers are limited to ensure that each attendee can be fully involved please reserve your place on our Eventbrite page by clicking here.